James Duffy and James Sanders

Understanding a payment’s journey around the globe can be difficult. As the operator of the UK’s high-value payment system (CHAPS), the Bank is all too familiar with this challenge. By leveraging the benefits of the newly introduced ISO 20022 standard for messaging, we have devised a new methodology to identify and classify cross-border CHAPS payments more effectively. This method reveals that international transactions form over half of CHAPS activity, and offers new insights into the global payment corridors for CHAPS payments. Gaining a deeper understanding of payment flows could assist policymakers in prioritising their efforts to reduce global barriers as they implement the G20 roadmap for enhancing cross-border payments.

What are cross-border payments?

When a payment travels internationally, there may not be a direct flight to its destination. If a sending bank (Bank A) does not have a direct relationship with the foreign recipient (Bank B), the payment will take a connecting flight ie, through correspondent banks, which have a relationship with both parties. In CHAPS, we can see payments moving between correspondent banks domestically, either prior to being sent abroad or having already arrived from overseas. We can also detect payments arriving from abroad, where the UK is the ultimate destination. So, while CHAPS is not directly involved in the international leg of the payment, we can detect cross-border activity by identifying the location of the ultimate debtor’s or creditor’s bank.

Figure 1: A stylised correspondent banking relationship

Why are we talking about them?

Sending cross-border payments can be inefficient due to complex correspondent banking chains, inconsistent data standards, and mismatched RTGS settlement hours between jurisdictions. These frictions (among others) contribute to high costs (up to 10% of a payment’s value), excessive delays (as long as 10 days), limited access, and poor transparency. Such inefficiencies affect the operations of large corporations and small businesses alike, but perhaps most disproportionately impact individuals sending personal remittances abroad. Remittances to low and middle-income countries can reach 38% of GDP, illustrating their vital role in social welfare and the importance of improving cross-border payment infrastructure.

The G20 has prioritised enhancing cross-border payments, and has developed a ‘roadmap’ to achieve this. The roadmap outlines quantitative targets designed to address key challenges, alongside 15 ‘priority actions‘ intended to help achieve these targets. Our work directly supports priority action 8 (among others), which highlights the importance of adopting a harmonised version of ISO 20022. Through analysis of ISO 20022 data, better understanding of global payment chains could support policymakers in their journey to achieve the G20’s global targets.

What made them so hard to track?

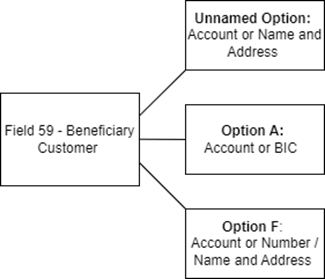

Finding geographic information in payment messages can be challenging. Legacy ‘MT’ messages often permitted multiple formats for the data contained within a field, or even free text. This lack of a consistent location for geographic information (namely Business Identifier Codes (BICs) and International Bank Account Numbers (IBANs)), prevented the automated detection of the ultimate debtor’s or creditor’s banks. Attempts at using text mining to solve these problems resulted in complex code that took as long to write as it took to execute. Figure 2 illustrates this BIC in a payment stack issue. In this message, a BIC or IBAN could be present, but hard to separate from surrounding information. The choice of three permitted formats, and the fact that ‘Account’ may or may not be an IBAN, adds further complexity.

Figure 2: Beneficiary customer information in an MT message

ISO 20022 to the rescue!

Last year, CHAPS migrated from MT messaging to the new global messaging standard, ISO 20022 (arguably the best ISO standard since ISO 3103). This standard offers many benefits, including enriched and more structured data. The structured, xml-based, format of ISO 20022 messages replaces the MT message’s free-text and multiple option fields. With that, we have greater certainty as to where geographic information appears within payment messages.

Classifying CHAPS payments

The consistency and structure of ISO 20022 messages facilitated the development of code that automatically extracts the BIC or IBAN from payment messages (when they are populated). Since both the BIC and IBAN contain a two-digit country code (thanks to ISO 3166 for the standardised country codes and names), the classifier can identify the sending and receiving countries for a payment. When either the debtor’s or creditor’s account country code is not ‘GB’ our classifier flags the payment as cross-border and records the sending and receiving countries. Not needing to use complex text mining allows us to run our classifier on the population of payments, rather than using a sample-based approach.

Initial findings – headline statistics

We ran our classifier over a full year following the implementation of ISO 20022 data (July 2023–June 2024) which included 51.6 million payments totalling over £87 trillion (28 times UK GDP).

During this period, we found that:

- cross-border activity accounted for at least 52% of CHAPS payments by volume, making CHAPS a majority cross-border system;

- cross-border payments comprise at least 41% of value settled in CHAPS;

- payments classified as cross border had an average value of £1.3 million, which is lower than that of all other payments, at £2.1 million; and

- cross-border payments exhibited a higher proportion of financial institution payments compared to the overall CHAPS payment population. Approximately 34% of cross-border payments were financial institution payments (pacs.009), while 65% were customer payments (pacs.008). In the broader CHAPS population, these figures were 24% and 76%, respectively.

For the period studied, the classifier identified both the sending and receiving country for most payments (83%). Therefore, a portion (17%) of our payments remain completely or partially unclassified. For a partially unclassified payment where the classified leg is cross border (2% of payments), we already know this is cross border. Payments that are entirely unclassified or have one domestic leg could still be cross border (15%). Therefore, while we know that at least 52% of CHAPS payments are cross border, the true number could be as high as 67%.

The art of cross-border activity

In our quest to better understand the complex web of cross-border activity, we discovered that payments can be turned into artwork. The chord diagrams below take us on a visual tour of payment activity, where the width of the bands represents the magnitude of the flows between countries. Colours indicate the sending countries. The charts depict flows between the 10 largest countries by volume and value, with payments originated by countries outside the top 10 captured by the ‘Other’ category (containing 207 country codes). Domestic (UK to UK) payments are omitted.

Figure 3: Cross-border activity by volume

Looking at CHAPS payments by volume, we can see that European countries represent some key payment corridors. European countries occupy seven of the top 10 (non-UK) places for payments sent and received by volume, accounting for 11% of total CHAPS volume. That said, the US accounted for greatest proportion of cross-border activity by volume at 3% of total CHAPS traffic. Ireland and Luxembourg rank 2nd and 3rd respectively. Together, the top 10 non-UK countries represented 16% of CHAPS volume sent and received.

Figure 4: Cross-border activity by value

When analysing payments by value, Belgium takes the top spot, surpassing the United States. Belgium accounts for 4% of total CHAPS value settled from less than 1% of volume. The top 10 rankings see Belgium, Canada and Australia replacing the volume giants of Ireland, Spain, and India. In addition, the value profile of CHAPS activity is more concentrated than the volume profile, indicated by a smaller ‘Other’ category. European countries lose a spot on the podium, representing six of the top 10 countries by value, compared to seven by volume. The top 10 non-UK countries accounted for 22% of CHAPS value sent and received (compared to 16% of volume).

It is important to note the role of financial market infrastructures (FMIs) within CHAPS. FMIs often send and receive low volume, high-value transactions. Their presence internationally means that the distribution of the value profile for cross-border payments (Figure 4) is sensitive to the activity and location of these participants. An example of this is Euroclear, operating in Belgium.

Policy relevance – extended RTGS settlement hours

This analysis could support central banks in assessing the impacts of extending RTGS settlement hours – a key component of the G20 roadmap’s priority theme, payment system interoperability and extension. Currently, significant delays in international transactions are caused by ‘gaps’ in settlement hours between jurisdictions, where both countries’ systems are not operating simultaneously. By quantifying the most important international payment corridors, this work may facilitate further analysis of the benefits of bridging particular gaps. See the Bank of England’s discussion paper on extended settlement hours.

Unlocking the secrets of cross-border payments

This exploratory analysis provides some early evidence of the merits of ISO 20022 and the importance of using enriched data. As a dedicated Payments Data and Analytics Team, we hope this research will spark further discussion and we invite any questions you may have related to this work.

James Duffy and James Sanders work in the Bank’s Payments Strategy Division.

If you want to get in touch, please email us at [email protected] or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

Share the post “Payments without borders: using ISO 20022 to identify cross-border payments in CHAPS”

Publisher: Source link