Benjamin Crampton, Rupert-Hu Gilman and Rebecca Mari.

With climate change set to increase the frequency and intensity of flooding in the UK, it is important to deepen our understanding of the potential microeconomic impacts that may propagate into the macroeconomy. We integrate firm-level corporate records, with Ordnance Survey business-premise address information and publicly available flood maps to investigate two questions. First, what characteristics of firms are associated to the historical exposure and current risk of flooding; and second, what is the impact of flood events on corporate outcomes. We find significant sectoral, spatial and structural heterogeneity among firms in their risk and exposure to flooding. Larger firms are more likely to locate in flood zones, while small and medium-sized enterprises (SMEs) and natural-resource-related industries have historically been impacted most heavily.

What drives flood risk exposure at firm level?

Looking at the incidence of past flooding, we find that around 0.4% of UK corporate business premises are located in areas that have been flooded over 2011–21. We find the regions most affected over this period are Cumbria and West Yorkshire. Respectively, 4.3% and 2.5% of business premises are located in flooded areas in these regions. While our historical analysis gives an indication of the number and type (Table A) of firms that sort into areas of past flood exposure, it does not necessarily provide a good indicator of their current flood risk. For example, deterioration of the coast, or the development of flood barriers, can impact risk levels substantially. Data on flood risk scores – which are conditional on flood defences – provide a better representation to this end.

Our data suggest that 10% of UK business premises are located in a flood plain. Around 20% of UK business premises are shielded by flood defences, which often mitigate their flood risk exposure. There is significant heterogeneity in exposure to flood risk across sectors and regions. Overall, the utilities sector presents the highest vulnerability from flooding, with over 10% of its employment and revenue at high-medium risk. Another sector highly exposed is agriculture, with over 13% of its revenue at high-medium risk.

We further investigate the determinants of flood risk at firm level through a business-premise-level multinomial logistic regression model estimating the impact of sector, region and firm-specific characteristics on the odds of flooding (the higher the odds, the higher the flood risk/exposure likelihood). The results suggest that corporate exposure to flood risk is, in large part, explained by region and sector-specific structural flood risk exposures, such as the elevated presence of watercourses at regional level and sectoral dependence on water, as in the case of utility firms.

When this is controlled for, we find that larger business premises (and firms) are more likely than smaller premises (and firms) to locate in areas with either a high-medium risk of flooding or that have been flooded at least once over the last decade (Table A). Some of these large business premises are distribution centres of major firms that may have implications for supply chain disruptions in the macroeconomy.

Table A: Multivariate logistic regression results

Notes: Core BP is a dummy equal to 1 if the business premise hosts a firm’s core activity (eg a retail store for a retailer). Tradeable is a dummy equal to 1 if the firm operates in a tradeable sector. Individual dummies control for the business premise size by quartile. Fixed effects for the firm’s sector (based on SIC 1-digit sector classification) and the business premise’s region (ITL 2) are controlled for.

What is the impact of a flooding event on corporate outcomes?

Business termination

We explore the impact of flooding on the probability of business termination at firm level through a Cox proportional hazards model. We find that experiencing flooding in one of the premises of small and medium-sized firms, but not large, is linked to a significant increase in the probability of termination for a given business (Chart 1).

Chart 1: Average impact of flood on business termination hazard ratio in shock year

In the case of small-sized firms, experiencing a flooding of business premises is associated with a 32% increase in the hazard ratio of business termination (hazard ratio of one suggests firms are just as likely to terminate their business than survive; ratio of 0.5 means firms half as likely to terminate than survive) in the year of the shock. When a flooding event is experienced within less than three years after the previous (‘repeated flooding’) the impact on the hazard ratio of business termination following the flood increases to 92%. Medium-sized firms are also susceptible to an increase in the probability of business termination in the year in which they experience flooding, with that event increasing the hazard ratio by 43%. They appear robust to occurrences of repeated flooding though, perhaps suggesting that they can recover faster from the shock relative to small-sized businesses.

Part of the difference in estimated average impacts can also be traced back to a difference in the average flooding intensity (ie percentage of total premise area flooded) experienced across firm size (Table B). Small-sized firms experienced a marginally higher average flooding intensity: 40% of their total business premise area versus 35% for medium-sized firms.

Table B: Average flood intensity proportion by firm characteristic

(a) Includes agriculture, mining and quarrying, and utilities.

For both small and medium-sized firms, however, we find that the increase in the probability of business termination as a result of a flooding event quickly reverts to baseline after the year of the shock. This suggests that the increase in business termination from flooding is strictly associated to the significant short-term disruptions caused by the event, such as damage to the business premises and to the inventory, or reduced accessibility of the premise.

Business performance

We then assess the impact on firm-level outcomes, for those firms surviving, through a generalised difference-in-difference model using the percentage of business premise area flooded as a measure for treatment intensity (those not flooded as controls). We use two different data sources to investigate the impact of flooding on business outcomes: the Business Register annual corporate balance sheet information for medium and large-sized firms, and Experian quarterly bank accounts balance data for small and medium-sized firms.

Looking at annual balance sheet data we find that, among those continuing their operations, flooding to a business premise is associated with a significant reduction in the firm turnover, employment and total assets on the year of the flood, followed by a recovery in subsequent years. The impact is however heterogeneous across firm size and sector of economic activity.

Large-sized firms experience a reduction in turnover and employment by 28% and 31% respectively in the year of the flood, both larger than the ones experienced by medium-sized firms (15% and 22% reductions, respectively). This difference is however largely driven by the higher survival rate of large-sized firms relative to medium ones following the event. The higher resilience of large firms is potentially driven by their greater financial capacity and a lower likelihood that the flooded premise is their sole premise, rather than one of multiple branches.

Across sectors, we find a higher negative impact for firms operating in natural-resource-related sectors (ie agriculture, mining and quarrying, and utilities). Natural-resource-related sectors experience a reduction in turnover by 63% in the year of flooding. This is on average 16 percentage points larger than that experienced by the other sectors and with no significant recovery in the years after the shock. The impact on employment is instead broadly similar across sectors, with a reduction of around 50% in the year of flooding, except for manufacturing which shows more resilience with an impact 10 percentage points smaller. Finally, natural-resource-related sectors experience the largest reduction in total assets from flooding, dropping by 63% in the year of the shock. Overall, these results suggest a vulnerability of natural-resource-related sectors to flooding, leading to higher losses/disruption at the time of the shock and a weaker post-shock recovery relative to the other sectors.

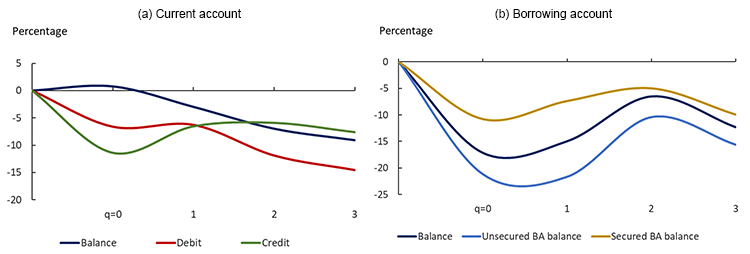

Looking at bank account balance data, we find a sizeable negative impact of flooding on SMEs’ current account (CA) and borrowing account (BA) balances (Chart 2). On the quarter of the shock, both revenues (CA credit) and expenses (CA debit) decrease significantly (Chart 2a). One year after the shock, the current account balance of SMEs affected remains on average 9% lower. Similarly persistent is the estimated impact on SMEs’ borrowing (Chart 2b), which remains 12% lower one year after the shock, with a larger impact observed for unsecured versus secured borrowing. Given the reduction in current account balances, it is unlikely that the reduction in the borrowing account balances is indicative of SME resilience, but more likely a reduced ability to borrow.

Chart 2: Average impact on SMEs’ bank account balances

In summary, our findings suggest significant heterogeneity among firm/premise type and size in their flood risk and past exposure. In particular, larger firms (and premises) locate in areas of higher flood risk and past exposure over the last 11 years. While the impact of flooding on large firms is also significant, we find that the impact on business termination likelihood is highest for SMEs. Sectorally, natural-resource-related firms are hit particularly hard in terms of their turnover, employment and total assets. These findings help to inform our understanding of vulnerabilities to flooding across different sectors of the economy and types and size of firms.

As flooding increases in frequency and severity, these vulnerabilities are more likely to have wider implications for the macroeconomy as supply, demand, and financial channels have the ability to amplify and propagate microeconomic effects. For example, inflationary pressures from disrupted supply chains (eg food price inflation). Looking ahead, we will need to be cognisant of these potential economic impacts from climate change in the UK.

Benjamin Crampton works in the Bank’s Advanced Analytics Division, Rupert-Hu Gilman works in the Bank’s Data Strategy and Implementation Division, and Rebecca Mari works in the Bank’s Monetary Analysis Structural Economics Division.

If you want to get in touch, please email us at [email protected] or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

Share the post “Staying afloat: the impact of flooding on UK firms”

Publisher: Source link