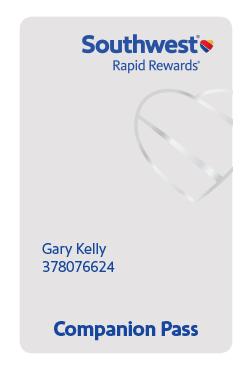

The Southwest Companion Pass is one of the most coveted elite travel benefits. It has been around for a long time now, and surprisingly, it still delivers the same great value as always.

This pass allows another passenger to fly with you for free as many times as you want. They only need to pay taxes for their fare. Traditionally, the pass is valid for the rest of the year it’s earned, plus the entire following year. That’s why it’s best to earn it early in the year, and possibly start working on earning it even earlier.

Requirements to earn this pass have increased a bit over the years, but thanks to Southwest Rapid Rewards credit cards you can still earn it without even flying. So how does the Southwest Companion Pass work? How can you earn it with credit card? How can you maximize its value? Let’s jump into the details and see if getting the Southwest Companion Pass makes sense for you.

What is the Southwest Companion Pass?

The Companion Pass stands out as a coveted feature within the Southwest Rapid Rewards program, offering significant savings. This perk enables you to select a travel companion to accompany you on any Southwest flight for free, while only paying any taxes and fees. Those generally cost as low as $5.60 one-way for a domestic flight.

You can use your pass regardless of whether you’re paying for your ticket with cash or points. It works for domestic flights as well as Southwest’s international destinations. There is no limit to how many times you use it while you’re eligible.

The Southwest Companion Pass is valid for the rest of the year it is earned, plus all of the following year.

You can also change your designated companion up to three times per calendar year. That means that you do not have to bring the same person along each time you use it.

The are two major rules to keep in mind when using your pass. First there must be at least one seat available for sale in any fare class on a flight for which you’ve purchased your own ticket. And also, your companion cannot fly without you.

Southwest Companion Pass Requirements

To earn the Southwest Companion Pass, you must fulfill one of the following requirements:

- Complete 100 qualifying one-way flights within a calendar year, or

- Accumulate 135,000 Rapid Rewards points within a calendar year. Qualifying points encompass those earned through revenue flights booked with Southwest, points acquired from Southwest credit card usage, and base points obtained from Rapid Rewards partners.

Meeting either of these criteria grants you the Companion Pass for the remainder of the qualifying year and the subsequent calendar year. For instance, if you earn the Companion Pass in January 2024, it will be valid until the until December 31, 2025.

Best Way to Earn the Southwest Companion Pass

Unless you’re flying Southwest quite frequently, the best way to earn the Southwest Companion Pass is by accumulating the 135,000 Rapid Rewards points within a calendar year.

That requirement might seem intimidating at first, but credit cards can help. They usually come with good welcome bonuses, you earn Rapid Rewards for everyday purchases, and since 2023, you get an automatic 10,000-point boost each year simply by having a cobranded Southwest card. All those points count toward the Companion Pass requirements.

Getting one of these cards gets you well on your way to earning the Companion Pass. You can also apply for a small business and personal Southwest credit card to make it even easier. Obviously it’s best to apply when there’s an elevated welcome offer, and you need to keep an eye on your Chase 5/24 status to be eligible for those welcome bonuses.

Southwest Credit Cards

Southwest Airlines has three consumer credit cards which normally have welcome bonuses varying between 50,000 and 75,000 Rapid Rewards points. All three cards usually have the same bonus, but they have different benefits and annual fees. Here are the three cards:

Southwest also offers two small business credit cards with welcome offers usually varying between 60,000 and 120,000 points:

You can earn one of the consumer credit card bonuses if you don’t have one of the three cards, and if you have not earned a bonus through those cards within the last 24 months. So you can’t apply for two personal credit cards. However, that rule does not apply to cardmembers of the Southwest Rapid Rewards Business Card and Employee Credit Card products. So it is possible to apply and earn the welcome bonus for a small business card and a consumer credit card.

More Ways to Earn Rapid Rewards

While credit card welcome bonuses get you a large amount of points at once, there are other ways to get you over the finish lines if you still need more Rapid Rewards.

You can shop online through Southwest’s Rapid Rewards Shopping mall and earn extra points for your purchases. There are tons of popular merchants listed on that shopping portal, so it is definitely worth checking out. They also offer frequent bonuses.

Flying Southwest and paying with a Southwest card will earn you 2 points per $1 spent. So a $200 flight will get you 200 points for example. You can also join Rapid Rewards Dining and earn more qualifying points when dining at participating restaurants and pay with your enrolled card.

Things like point transfers, or buying Rapid Rewards will not count for the Companion Pass.

Best Time to Earn the Southwest Companion Pass

As mentioned above, the Companion Pass is valid for the remainder of the year in which you earned it, plus the following full calendar year. So it makes sense to earn it as early as possible in a calendar year, so you can enjoy it for almost two full years.

But timing is everything. Once those 135,000 Rapid Rewards hit your account within a year, the clock starts.

So let’s say that you are looking to earn the pass for 2024 and 2025 through credit card bonuses. Then you want your welcome bonus points to hit your account in January of 2024. To do that, you will need to meet the minimum spend requirement after your December statement close date. That way, the welcome bonus will post on your January statement close date.

Points are credited on your the credit card statement closing date, which is different from your payment due date. This date is listed in your credit card statement, but if you haven’t received your card yet, you can call or message Chase to ask when the closing date is. It’s also worth noting that you can request to change your closing date if you want to time things better.

Just keep in mind that you normally have three months to met the minimum spend requirement, from the date of approval. That doesn’t change when you change your closing date.

Publisher: Source link