Julian Reynolds

Policymakers and market participants consistently cite geopolitical developments as a key risk to the global economy and financial system. But how can one quantify the potential macroeconomic effects of these developments? Applying local projections to a popular metric of geopolitical risk, I show that geopolitical risk weighs on GDP in the central case and increases the severity of adverse outcomes. This impact appears much larger in emerging market economies (EMEs) than advanced economies (AEs). Geopolitical risk also pushes up inflation in both central case and adverse outcomes, implying that macroeconomic policymakers have to trade-off stabilising output versus inflation. Finally, I show that geopolitical risk may transmit to output and inflation via trade and uncertainty channels.

How has the global geopolitical outlook evolved?

Risks from geopolitical tensions have become of increasing concern to policymakers and market participants this decade.

A popular metric to monitor these risks is the Geopolitical Risk (GPR) Index constructed by Caldara and Iacoviello (2022). The authors construct their index using automated text-search results from newspaper articles. Namely, they search for words relevant to their definition of geopolitical risk, such as ‘crisis’, ‘terrorism’ or ‘war’. They also construct GPR indices at a disaggregated country-specific level, based on joint occurrences of key words and specific countries.

Chart 1 plots the evolution of the geopolitical risks over time. Most notably, the Global GPR Index (black line) spikes following the 11 September attacks. More recently, this index shows a sharp increase following Russia’s invasion of Ukraine in February 2022.

Country-specific indices typically co-move significantly with the Global index but may deviate when country-specific risks arise. For instance, the UK-specific (aqua line) and France-specific indices (orange line) show more pronounced spikes following terrorist attacks in London and Paris respectively, while the Germany-specific index (purple line) rises particularly strongly following the invasion of Ukraine.

Chart 1: Global and country-specific Geopolitical Risk Indices

The GPR index is similar to the Economic Policy Uncertainty (EPU) index, produced by Baker, Bloom and Davis. The EPU index is also constructed based on a text search from newspaper articles, and available at both a global and country-specific level. But it measures more generic uncertainty related to economic policymaking, besides uncertainty stemming from geopolitical developments.

How to quantify the macroeconomic impact of these developments?

In light of increasing concerns about geopolitical tension, a growing body of literature aims to quantify the macro-financial impact of these developments. For instance, Aiyar et al (2023) examine multiple transmission channels of ‘geoeconomic fragmentation’ – a policy-driven reversal of global economic integration – including trade, capital flows and technology diffusion. Also Caldara and Iacoviello (2022) employ a range of empirical techniques to examine how shocks to their GPR affect macroeconomic variables.

These studies unambiguously show that geopolitical tension has adverse effects on macroeconomic activity and contributes to greater downside risks. But empirical estimates tend to differ significantly, depending on the nature and severity of scenarios through which geopolitical tensions may play out.

My approach focusses on the impact of geopolitical risks on a range of macroeconomic variables. Namely, I use local projections (Jordà (2005)), an econometric approach which examines how a given variable responds in the future to changes in geopolitical risk today. I employ a panel data set of AEs and EMEs (listed in Table A), with quarterly data from 1985 onwards.

Table A: List of economies

Notes: Countries divided into Advanced and Emerging Market Economies as per IMF classification. Country-level EPU indices available for starred economies.

Following Caldara and Iacoviello (2022), I regress a given variable on the country-level GPR index, controlling for: country-level fixed effects; the global GPR index; the first lag of my variable of interest; and the first lags of (four-quarter) GDP growth, consumer price inflation, oil price inflation, and changes in central bank policy rates.

I use ordinary least squares estimation to estimate the mean response over time of a given macroeconomic variable to geopolitical risk. But to assess the impact of geopolitical risk at the tail of the distribution, I follow Lloyd et al (2021) and Garofalo et al (2023) by using local-projection quantile regression. This latter approach uses an outlook-at-risk framework to illustrate how severe the impact of geopolitical risk could be under extreme circumstances.

How does geopolitical risk affect GDP growth and inflation?

Chart 2 show the impact of geopolitical risk on average annual GDP growth across my panel of economies. In the mean results (aqua line), a one standard deviation increase in geopolitical risks is expected to reduce GDP growth by 0.2 percentage points (pp) at peak. But at the 5th percentile – a one-in-twenty adverse outcome – GDP growth falls by almost 0.5pp. In other words, this means that geopolitical risk both weighs on GDP growth but also increases the severity of tail-risk outcomes, adding to the global risk environment.

The magnitude of these effects is somewhat smaller than Caldara and Iacoviello (2022), though they use a longer time sample (1900 onwards), which includes both World Wars.

Chart 2: Dynamic impact of geopolitical risk on GDP growth

Notes: Shaded areas denote 68% confidence interval around Mean and 5th percentile estimates.

The impact of geopolitical risks on GDP growth is heterogeneous across AEs and EMEs. Chart 3 plots the impact of geopolitical risk at the one-year horizon for both groups of economies, at the mean and 5th percentile. For AEs, the mean impact of geopolitical risk on GDP growth appears to be negligible, though the 5th percentile impact is more noticeable. For EMEs, however, both the mean and 5th percentile impact of geopolitical risk are material. This result is consistent with Aiyar et al (2023), who show that EMEs are also more sensitive to geoeconomic fragmentation in the medium term.

Chart 3: Impacts of geopolitical risk on GDP growth at one-year horizon, by country group

Notes: Shaded areas denote 68% confidence interval around Mean and 5th percentile estimates.

I also find that geopolitical risk tends to raise consumer price inflation, consistent with Caldara et al (2024) and Pinchetti and Smith (2024). This could pose a challenging trade-off for a macroeconomic policymaker, between stabilising output versus inflation.

Chart 4 shows that at the mean, average annual inflation rises by 0.5pp at peak, following a geopolitical risk shock. But at the 95th percentile (one-in-twenty high inflation outcome), inflation rises by 1.4pp. As with GDP, the inflationary impact of geopolitical risk shocks appears to be larger for EMEs, though the mean impact on AE inflation is also statistically significant (Chart 5).

Chart 4: Dynamic impact of geopolitical risk on consumer price inflation

Notes: Shaded areas denote 68% confidence interval around Mean and 95th percentile estimates.

Chart 5: Impact of geopolitical risk on consumer price inflation at one-year horizon, by country group

Notes: Shaded areas denote 68% confidence interval around Mean and 5th percentile estimates.

What are the potential transmission channels?

One key channel through which geopolitical risk could transmit to GDP and inflation may be disruption to global commodity markets, particularly energy. Pinchetti and Smith (2024) highlight energy supply as a key transmission channel of geopolitical risk, which pushes up on inflation. Energy price shocks could also have significant effects on GDP and inflation in adverse scenarios (Garofalo et al (2023)).

The inflationary impulse following Russia’s invasion of Ukraine marks an extreme instance of commodity market disruption (Martin and Reynolds (2023)). Sensitivity analysis suggests that even excluding this period, geopolitical risk still has trade-off inducing implications for inflation and GDP.

I also find that geopolitical risk leads to significant disruption in world trade, a channel also highlighted by Aiyar et al (2023). Chart 6 plots the estimated impacts on trade volumes growth (measured by imports), while Chart 7 plots the impact on trade price inflation (measured by export deflators). These results imply that both trade volumes and prices are highly sensitive to global geopolitical risk. The peak response of trade volumes growth to geopolitical risk is around three times greater than GDP, at the mean and 5th percentile. And the peak response of export price inflation – representing the basket of tradeable goods and services – is significantly greater than that of consumer prices, at the mean and 95th percentile.

This implies that countries are likely to be exposed to global geopolitical risk via the effect on trading partners: falling import volumes for Country A means that Country B’s exports fall, weighing on GDP; higher export prices for County A means that Country B imports higher inflation from Country A.

Chart 6: Dynamic impact of geopolitical risk on trade volumes growth

Notes: Shaded areas denote 68% confidence interval around Mean and 5th percentile estimates.

Chart 7: Dynamic impact of geopolitical risk on trade price inflation

Notes: Shaded areas denote 68% confidence interval around Mean and 95th percentile estimates.

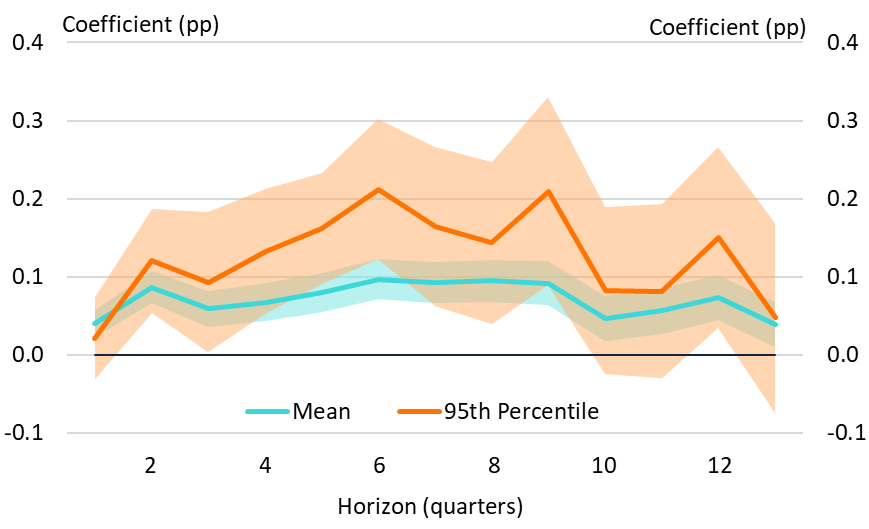

Finally, I find that greater geopolitical risk is associated with somewhat greater economic uncertainty. Chart 8 shows the response of country-specific EPU indices (compiled by Baker, Bloom and Davis) to an increase in geopolitical risk. This implies a mean cumulative increase in uncertainty of around 0.1 standard deviations; the peak impact at the 95th percentile is twice as great.

This impact, while statistically significant, appears relatively small in an absolute sense. For context, the US-specific EPU index rose by two standard deviations between 2017 and 2019, after the onset of the US-China trade war. Nonetheless, it is plausible that uncertainty may be a key transmission channel for geopolitical tensions in the medium term, which may particularly weigh on business investment (Manuel et al (2021)).

Chart 8: Dynamic impact of geopolitical risk on economic policy uncertainty

Notes: Shaded areas denote 68% confidence interval around Mean and 95th percentile estimates.

Conclusion

This post presents empirical evidence which quantifies the potential macroeconomic effects of geopolitical developments. Geopolitical risk weighs on GDP growth, in both the central case and tail-risk scenarios, and is also likely to raise inflation via a number of channels.

Further studies may look to refine the identification of geopolitical risk shocks, to purge the underlying series of endogenous relationships with macroeconomic variables. Further analysis may also be helpful to substantiate why EMEs appear more sensitive to geopolitical risk than AEs, particularly transmission via financial conditions and capital flows. Given the heightening geopolitical tensions that policymakers have highlighted, further research into the macro-financial implications of these tensions is highly important at this juncture.

Julian Reynolds works in the Bank’s Stress Testing and Resilience Group.

If you want to get in touch, please email us at [email protected] or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

Share the post “Quantifying the macroeconomic impact of geopolitical risk”

Publisher: Source link