If you’re looking for an affordable term life insurance policy that you can obtain quickly, you need to check out Ladder. Their streamlined online application can have you approved in a matter of minutes. And according to Ladder, many applications are approved without a medical exam requirement. Learn more in our Ladder review.

If you’re looking for an affordable term life insurance policy that you can obtain quickly, you need to check out Ladder.

Their streamlined online application can have you approved in a matter of minutes. And according to Ladder, many applications are approved without a medical exam requirement.

In this Ladder review, I’ll let you know what types of policies they offer, key features, who is eligible, and how much you can expect to pay.

Introducing Ladder Insurance

Ladder is a California-based online life insurance provider offering coverage through established life insurance companies.

Founded in 2015 and launched in 2017, Ladder’s insurance partners include Allianz Life Insurance Company of New York, Fidelity Security Life Insurance Company®, and its affiliate, Ladder Life Insurance Company.

While the entire application process is online, you can get help from licensed insurance professionals, if needed, who are happy to help.

How Ladder Term Life Insurance Works

Ladder only offers term life insurance policies. Ladder’s mission is to offer affordable policies with speed and ease. Term life insurance best fits that product type.

When applying with Ladder, you should be aware the company does not offer policy riders. These optional additional coverage provisions provide more benefits but at a higher premium. That higher premium is the reason why Ladder doesn’t offer them.

Ladder’s most unique feature is that it allows you to increase or decrease your coverage as needed.

Laddering Up/Laddering Down

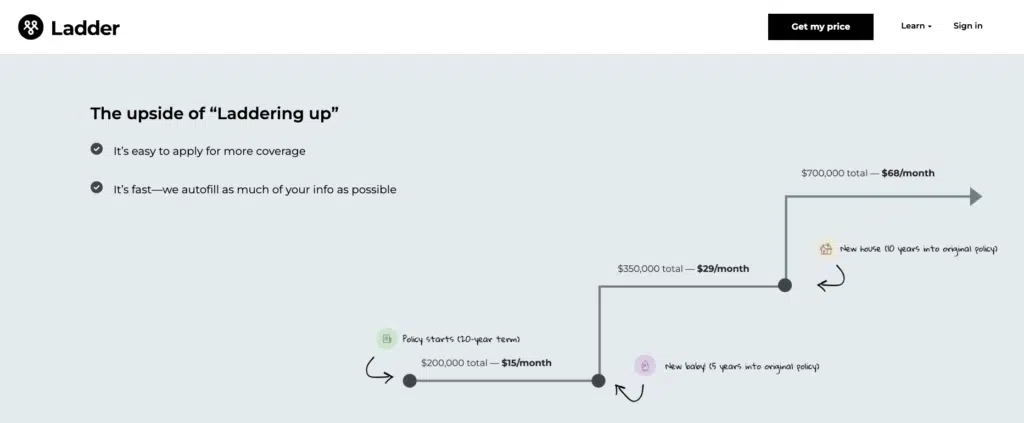

The name Ladder hints at its most unique feature – the ability to increase or decrease your coverage as needed. The process is known as ‘laddering up’ or ‘laddering down.’

Existing policyholders can increase their death benefit amount as their needs change, subject to underwriting and approval.

Conversely, if your coverage needs decline, you can reduce the death benefit. In short, Ladder Life puts you in charge of the policy’s face amount and the premium you’ll pay. You can request a change to your coverage by visiting the Ladder account page.

Laddering your policy, up or down, is completely free. And you can ladder your policy as often as you like. Naturally, the premium will increase if you ladder up the policy amount. And if you ladder down the death benefit, the premium will decrease.

Term Length Options

Ladder offers terms ranging from 10 to 30 years, the maximum term you can qualify for, regardless of age. That said, your age at the time of application may reduce the maximum term for which you qualify. The maximum issue age is 60.

Ladder uses a simple calculation to determine the maximum term length of a policy. Your current age, plus the term length, cannot exceed 70. For example, if you’re 40, the longest term is 30 years (40+30 = 70.) If you’re 50, the longest term is 20 years (50+20 = 70.)

Ladder policies are underwritten based on your nearest birthday. For example, if you will be 45 in four months, your age will be considered 45 years, not 44.

Policies are renewable for up to 5 years after the guaranteed level premium term. The new premium will be based on your age at renewal and, therefore, higher, but this is how term life insurance renewals work.

Ladder Pricing

Like all life insurance policies, Ladder policy premiums depend on a combination of factors. Those include your age at the time of application, health condition, occupation, hobbies and pastimes, and even geographic location.

We requested information for a non-smoking 40-year-old male in excellent health with no family history of major illnesses, and we received the following quotes for $1 million in coverage:

- 10 years – $37.50 per month

- 15 years – $47.70 per month

- 20 years – $61.80 per month

- 25 years – $96.90 per month

- 30 years – $114.30 per month

We then requested a policy for a non-smoking 40-year-old female in excellent health with no family history of major illnesses, and we received the following quotes for $1 million in coverage:

- 10 years – $35.40 per month

- 15 years – $46.80 per month

- 20 years – $52.50 per month

- 25 years – $77.10 per month

- 30 years – $88.50 per month

The monthly premiums for men are slightly higher than for women, which is common throughout the life insurance industry. This owes to the fact that women statistically live longer than men by several years.

The premium rate increases with the term of the policy because the longer the term, the greater the likelihood the company will ultimately pay the death benefit.

Ladder Maximum Coverage Limits

Ladder coverage limits range from a minimum of $100,000 to a maximum of $8 million (up to $3 million in CA).

If you apply for $3 million or less, you won’t have to take a medical exam, just answer health questions. Applicants applying for benefits greater than $3 million may need to submit to a medical exam.

Policies offered through Ladder have a single death benefit payout, which is paid in a lump sum to the beneficiaries upon the death of the insured.

Unlike some life insurance companies, there is no option to distribute benefits in installments or through any other payout method.

As mentioned, Ladder does not offer common life insurance riders, so you won’t have the ability to add provisions, such as a spousal rider, an accelerated death benefit (living benefits), double indemnity (increased death benefit for death caused by an accident), or a conversion provision that enables you to convert the term policy to a permanent, whole life policy before the term expires.

Ladder Coverage Eligibility

Ladder offers coverage for those between the ages of 20 and 60. If you are over 60, you’ll need to make an application elsewhere.

Each application is for a single individual, so there is no capability to apply jointly with your spouse or to add your children. Each person will need to complete a separate application.

Policies are available only to US citizens and lawful permanent resident aliens who have lived in the US for at least two years. Ladder offers policies in all 50 states, as well as the District of Columbia.

Ladder Application Process

The application process takes place online, which helps Ladder keep premiums low.

You can apply for coverage in as little as 5 minutes. You will not be required to complete a medical exam for coverage up to $3 million.

But for coverage above $3 million, the approval decision may be delayed several weeks.

Ladder Underwriting

When completing the application, Ladder will request basic information, like your name and email address.

In making the underwriting decision, they’ll also request the following information:

- Whether a biological parent or sibling has been diagnosed by a physician with diabetes, cancer, heart disease, Huntington’s Disease, or Lynch Syndrome before the age of 60?

- Your annual household income.

- How many children do you have?

- Your remaining mortgage balance.

Your answers to these and other questions will determine your eligibility for life insurance coverage, as well as the premium you’ll pay for the policy.

Is Ladder Legit?

Ladder Life is a legitimate term life insurance services provider, offering policies in all 50 US states. The following information indicates its financial strength and how it’s perceived within the insurance industry and by its customers.

Financial Strength

Since Ladder is not the direct issuer of the policies it offers, the company is not rated for financial strength by A.M. Best, the industry’s most well-recognized insurance company rating agency.

But the ratings for two of Ladder’s issuing companies are as follows:

- Allianz Life Insurance Company of New York, A+ (Superior)*

- Fidelity Security Life Insurance Company, A (Excellent)*

Since each of the companies is rated “A” or higher by A.M. Best, each is highly likely to have the financial strength to pay the policy death benefit, if necessary.

Ladder’s third issuing company is its affiliate, Ladder Life Insurance Company. Ladder Life Insurance Company has earned a Financial Stability Rating® (FSR) of A (Exceptional) from Demotech, Inc. FSRs are a leading indicator of financial stability, providing an objective baseline of future solvency.

The most current FSRs must be verified by visiting www.demotech.com

Third-Party Ratings

In addition to financial strength ratings by A.M. Best, we’ve also considered the credit rating of each of the three providers behind Ladder. The credit rating indicates the company’s ability to meet its financial obligations and continue operations as a going concern.

The news here is as good as it is with the financial strength ratings. The table below shows the credit ratings of two of the companies from two major corporate credit evaluation agencies:

| Insurance Company / Rating Service | Moody’s | Standard & Poor’s |

|---|---|---|

| Allianz Life Insurance Company of New York | Aa3 (4th of 21 ratings) | AA (3rd of 21 ratings) |

| Fidelity Security Life Insurance Company® | N/A | N/A |

Customer Service Ratings

Perhaps the best indicator of Ladder’s reputation as a life insurance services provider is to look at the ratings provided by the people who deal most closely with Ladder – its customers.

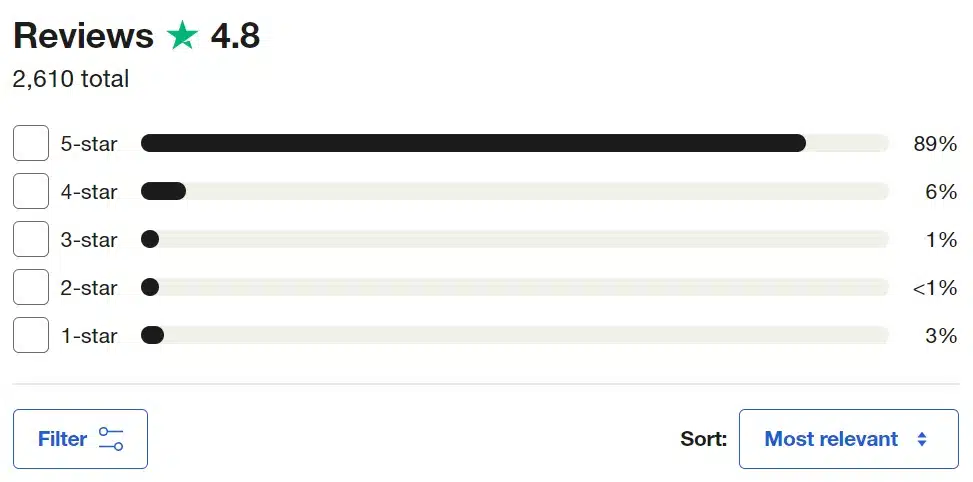

Ladder has an Excellent Trustpilot score of 4.8/5, based on over 2,600 customer reviews. 89% of customers have assigned them a 5-star rating, and only 4% rated them three stars or fewer.

We could not locate a rating for Ladder with the Better Business Bureau. However, the BBB has an “A+” (highest) rating for Fidelity Security Life Insurance Company® and has been agency-accredited since 1990.

There is, however, no BBB rating for Allianz Life Insurance Company of New York, perhaps because the company is an affiliated organization.

How We Evaluated Ladder Life Insurance

We’ve evaluated Ladder based on the policy terms offered, the dollar amount of the death benefits, and the premiums’ cost. We’ve also taken into account applicant eligibility, as well as the apparent underwriting criteria the company uses.

We’ve also considered third-party information about the company, including its financial strength and reputation. Finally, we considered factors that make Ladder Life unique regarding what niche they fill in the insurance industry.

Is Ladder a Good Company?

Ladder is one of the best online life insurance companies for term insurance. While they don’t offer as many coverage options as other providers (term life only, no riders), they provide straightforward term coverage that’s affordable and easy to apply for.

You can complete the entire process online, and if you’re in good health, you likely won’t require a medical exam.

Ladder partners with top-notch insurance companies and can boast very high customer ratings. And their Ladder Up/Down features only add to Ladder’s convenience.

Of course, if you fall outside Ladder’s qualifying criteria, i.e., over 60, want universal or whole life insurance, or require specialized coverage via insurance riders, then Ladder is not for you.

The bottom line is if you meet Ladder’s age requirements and are of good health, it’s one of the best places to get term life insurance – which is what the vast majority of American adults need.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Ladder

Product Name: Ladder Life Insurance

Product Description: Ladder is a life insurance services provider that offers term life insurance policies to consumers. It was founded in 2015 and is headquartered in Palo Alto, CA.

Summary

Ladder offers term life insurance coverage of between $100K to $8M with no medical exams for coverage up to $3M (just answer health-related questions). Adjust coverage anytime.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Pros

- Offers adjustable term life insurance ranging from 10 to 30 years in 5-year increments.

- The company has a user-friendly website and offers a range of online tools and resources to help consumers understand and compare different life insurance options.

- Offers no medical exam coverage up to $3M, which may be a good option for individuals who are unable or unwilling to undergo a medical exam as part of the application process.

Cons

- No-exam life insurance policies are typically more expensive than traditional life insurance policies

- May not be the best option for individuals with pre-existing health conditions or other risk factors

- Do not offer riders on their insurance policies such as: Accidental death and dismemberment (AD&D) rider, waiver of premium rider, or return of premium rider.

*Allianz Life Insurance Company of New York has been rated A+ (Superior) affirmed October 2021 and Fidelity Security Life Insurance Company® has been rated A (Excellent) based on an analysis of financial position and operating performance, by A.M. Best Company, an independent analyst of the insurance industry. For the latest rating, access www.ambest.com.

Ladder Insurance Services, LLC (CA license # 0K22568; AR license # 3000140372) offers term life insurance policies: (i) in California, on behalf of its affiliate, Ladder Life Insurance Company, Menlo Park, CA (policy form # P-LL100CA); (ii) in New York, on behalf of Allianz Life Insurance Company of New York, New York, NY (policy form # MN-26); and (iii) Fidelity Security Life Insurance Company®, Kansas City, MO (policy form # ICC17-M-1069, M-1069 and policy # TL-146) in the District of Columbia and all states except New York and California. Only Allianz Life Insurance Company of New York is authorized to issue life insurance in the state of New York. Insurance policy prices, coverages, features, terms, benefits, exclusions, limitations, and available discounts vary among these insurers and are subject to qualifications. Each insurer is solely responsible for any claims and has financial responsibility for its own products.

Publisher: Source link