Aydan Dogan, Melih Firat and Aditya Soenarjo

How does the use of imported inputs in production affect inflation dynamics in the UK? Over the past few decades, with the rise of global value chains (GVCs), production processes have become increasingly interlinked across countries and sectors. This interconnection means that firms’ pricing decisions are now more influenced by foreign factors. The importance of globalisation in shaping inflation dynamics was highlighted during the supply-chain disruptions caused by the Covid-19 crisis. In a recent paper, we explore the impact of the rising share of imported intermediate goods on the UK Phillips curve. We show that UK industries with higher shares of intermediate imports from emerging market economies (EMEs) have flatter Phillips curves.

The Phillips curve and globalisation

The response of inflation to the changes in domestic economic activity, summarised by the Phillips curve, is central to monetary policy making. Changes in this relationship can significantly affect the effectiveness of monetary policy decisions as argued by several policymakers (see eg Carney (2017) or Schnabel (2022)). Academics and policymakers are increasingly investigating the drivers behind inflation’s responsiveness to the output gap in a global economy. As discussed in Forbes (2019), globalisation can influence the Phillips curve through various channels, including competition, trade in final goods, and notably, trade in intermediate goods – a key feature of today’s trade landscape and a proxy for GVC trade. Here, we focus on trade in inputs because most of the current international trade involves GVCs, and trade in intermediate inputs constitutes a prominent share of the UK’s trade.

UK’s integration into GVCs

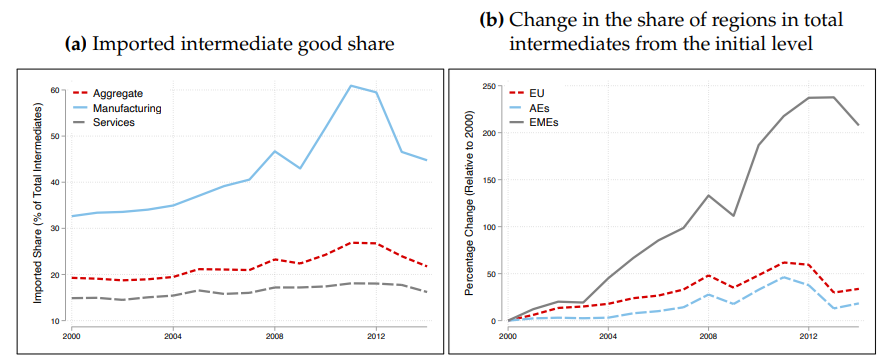

Over time, the UK economy has become more integrated into GVCs. Chart 1 (a) highlights the share of imported intermediates in total intermediate inputs across the aggregate economy, and services and manufacturing sectors separately from 1995 to 2014. The chart shows a significant increase in the imported intermediates share in the manufacturing sector, especially since the early 2000s. This period coincides with the rising role of EMEs in global trade. Chart 1 (b) also shows the percentage change in the share of imported intermediates in the manufacturing sector from various regions, indicating that the increase in the UK is mainly due to EMEs.

So, how has this integration into EMEs affected the UK’s Phillips curve?

Chart 1

Exploring the link between GVCs and inflation

To understand the relationship between GVCs and inflation, we used sectoral data from 2000 to 2014 and estimated the UK Phillips curve. By analysing the interaction between the sectoral dependence on imported intermediate goods and the sectoral output gap, we examined how GVCs, especially integration with EMEs, influenced the inflation-output gap relationship.

Our findings reveal that higher integration in GVCs is not systematically associated with a reduced response of inflation rate to changes in economic activity, ie flatter Phillips curves. Instead, the flattening effect depends on the source of the imports. We find that the sectors with higher shares of imported inputs from EMEs have flatter Phillips curves. However, this is not the case for imported inputs from advanced economies (AEs).

Economic significance of the findings

To illustrate the economic significance, consider what happens when a sector’s integration with EMEs increases. The Phillips curve coefficient – reflecting how much a sector’s inflation responds to changes in the output gap of that sector – is estimated to be 0.0433 at the average level of integration with EMEs. However, when you factor in the interaction between the output gap and the share of imported intermediate goods which is estimated to be -0.0426, the slope falls almost to zero: a one standard deviation increase in the share of imported intermediate goods from EMEs reduces the impact of the output gap on inflation to nearly zero. In simpler terms, as the share of imported intermediate goods from EMEs rises, inflation becomes much less responsive to changes in the output gap. Back-of-the-envelope calculations suggest that the Phillips curve coefficient reduced by 64% between 2000 and 2014 due to rising GVC integration with EMEs, after accounting for various effects.

The role of China

We also examined the specific impact of imported intermediate goods from China. By estimating the same Phillips curve relationship with imported inputs from only China and from EMEs excluding China, we found significant roles for both groups. This suggests that the effects of GVC integration into EMEs are not solely due to dependence on Chinese goods.

Why only EMEs?

Why do these results hold for EMEs but not for AEs? One reason could be the lower business cycle correlation between the UK and EMEs compared to AEs. When the UK economy integrates with countries that are less synchronised with its business cycle, like EMEs, the impact of demand-side shocks on prices may be reduced. In contrast, when integrated with AEs, where demand patterns are more aligned with the UK’s, the pass-through of demand shocks to prices is stronger. When firms use imported intermediates in their production, their marginal costs do not only move with fluctuations in wages but also with imported input prices. Firms however can switch between domestic and foreign inputs in response to shocks, reducing the pass-through from domestic input prices (and specifically wages) to prices. If UK firms import inputs from countries that have a low business cycle correlation with the UK, firms have the option of switching to cheaper imported intermediate goods from domestic goods. Following this shift in input demand of the UK sectors, the change in input costs would be limited.

To test this hypothesis, we calculated the business cycle correlation of each country with the UK and re-estimated the Phillips curve relationship. We found that importing more intermediates from countries with different business cycles than the UK (mostly EMEs) leads to a weaker inflation response to real economic activity. There was no significant effect for imports from countries with high business cycle correlations with the UK.

Conclusions

Our findings highlight the potential consequences of de-integration from GVCs and related concerns about inflation. Higher imported intermediate input shares from EMEs have reduced the sensitivity of inflation to changes in the output gap. Increasing globalisation and a larger role played by EMEs in GVCs contributed to flatten the Phillips curve. However, with the current trend of increased trade fragmentation, this dynamic may reverse. Whether the Phillips curve will become steeper again depends on how firms respond: if they significantly reduce their reliance on foreign inputs, inflation may become more sensitive to domestic economic conditions. Conversely, if firms diversify their trade partners within EMEs rather than reducing foreign input reliance, the impact on the Phillips curve may be less pronounced.

Aydan Dogan works in the Bank’s Global Analysis Division, Melih Firat is an economist at the IMF and Aditya Soenarjo is a PhD student at the LSE.

If you want to get in touch, please email us at [email protected] or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

Share the post “Global value chains and inflation: how imported inputs shape UK prices”

Publisher: Source link