Laura Achiro, Gerry Gunner and Neha Bora

A flow of funds framework is a way of understanding and tracking the movement of financial assets between different sectors of the economy. This blog specifically analyses UK corporate and household sectoral flows from 2000 to the present and highlights how this framework can reveal useful trends and signals for policymakers about the real economy. For instance, the accumulation of debt in the pre-global financial crisis (GFC) era by households and corporates was a warning signal that indicated several potential risks and vulnerabilities in the economy, including overleveraging and asset price inflation.

In our analysis, we look at the fluctuation of the surplus income or deficit positions for households and corporates. Fundamentally, each institutional sector runs an income surplus or deficit with one another in each period, depending on how much income and expenditure each sector has. These sector deficits require financing in one way or another, which is how the transfer of financial assets or liabilities comes into play. Net lending represents the overall surplus or deficit, and it is theoretically the same whether you look at it from the income or financial account viewpoint. The sector balance sheets track the amount of assets and liabilities outstanding after all of these flows have occurred, although the quality of the data for the sectors might vary significantly.

We discuss key trends from 2000 to the present in an attempt to understand the longer-term flows of funds in and out of the real economy. Throughout the blog, we argue that it is useful to have a flow of funds lens to provide the ‘macro’ context in which ‘macro-pru’ policy operates. In short, in this blog we state a brief case for how flow of funds can be an effective complement to the micro-data analysis which underpins the assessment of household and corporate risks in recent financial stability publications.

Evolution of the net lending positions of households and corporates

The pre-GFC era was a period of strong growth and low inflation, which coincided with a large expansion of credit. We utilise financial accounts data in Charts 1 and 2 to show how UK corporates and households substantially increased their debt burden.

Households’ net position (Chart 1) declined from a surplus in the early 2000’s to a position where the net position was close to zero, driven by strong growth in borrowing from UK banks (denoted by aqua bars), partially offset by savings inflows into banks, insurance, and pension funds (shown by purple and green bars). The increase in debt levels saw the aggregate household debt to income ratio (excluding student loans) increase between 2004 to 2008. While an increase in household debt can support economic growth through increased consumer spending, high levels of it can increase the chances of financial crisis, worsen the severity of a recession and curtail or stifle economic growth.

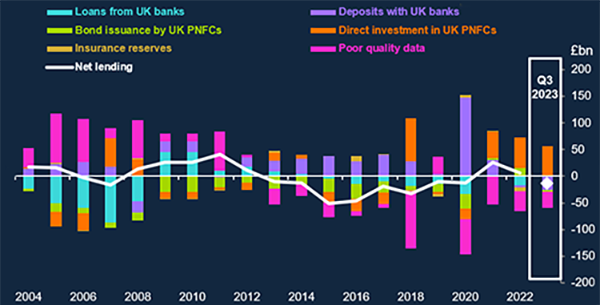

Meanwhile, UK corporates also increased their debt levels in the pre-GFC period as they borrowed from banks (aqua bars in Chart 2) while also taking advantage of the increased accessibility to capital markets where they issued bonds (green bars in Chart 2). Compared to households, corporates relied more on market based finance, and to a lesser extent on bank debt, and the borrowed funds were largely invested in commercial real estate and restructuring of balance sheets.

During the GFC period however, credit conditions tightened as banks withdrew credit, and this led to both households and corporates becoming net lenders to the economy. Additionally, house prices fell significantly lowering the value of collateral, and households endured job losses which made it difficult to sustain high debt levels. This fall in the supply and demand for credit can be seen from the reduction in loans from banks to households and corporates shown by the aqua bars in Charts 1 and 2. Corporates and households responded to the economic uncertainty by adjusting their balance sheets by building up cash deposits with banks, shown by the purple bars in Charts 1 and 2 from 2009 onwards.

Chart 1: Household net lending from the financial account (a)

Sources: Office for National Statistics (ONS) and staff calculations.

(a) Final data point is aggregated quarterly data in 2023 up to 2023 Q3.

In the post-crisis period, bank lending standards remained tight as seen by the lower flows of bank loans to both households and corporates (aqua bars in Charts 1 and 2) from 2010 until about 2013. Corporates were persistently deleveraging which reduced aggregate investment and credit growth in the immediate post-crisis period.

However, as disruptive effects of the crisis abated from about 2013, to the onset of the pandemic in 2019/20, corporates raised debt in the capital markets as well as through bank debt (aqua and green bars in Chart 2).

Chart 2: Corporate net lending from the financial account (a)

Sources: ONS and staff calculations.

(a) Final data point is aggregated quarterly data in 2023 up to 2023 Q3.

In 2020, the world was hit with a different kind of crisis that had economic effects on households and corporates

Charts 1 and 2 evidence how the shift in financial imbalances following the Covid pandemic were a stark contrast to the effects of the financial crisis. Concerns about commercial bank viability during the GFC led to a contraction in credit availability that had negative effects on the real economy. On the other hand, the pandemic initially led to a fall in demand due to lockdown restrictions and economic uncertainty. Households and corporates both accumulated savings leading to an overall increase in deposits with UK banks, with household and corporate deposit accumulation (purple bars in Charts 1 and 2) reaching a peak in 2020.

The pandemic saw the household net lending position increase to a historic high of around £180 billion, (Chart 1). In the meantime, corporates reduced their debt levels especially corporate bond issuance (green bars) as some parts of financial markets closed for a period of time in 2022 for the riskier borrowers reflecting additional caution by investors (Chart 2). The majority of large corporates refrained from substantially increasing their debt levels, although small and medium enterprises still took out debt on favourable terms offered by government-backed schemes as seen by the aqua bars in Chart 2, mainly for precautionary purposes. The corporates’ precautionary borrowing saw liquidity improve as they built up cash buffers with UK banks (purple bars in Chart 2).

And in the aftermath of the pandemic, built-up deposits have unwound

More recently, the costs of essential goods have risen faster than household incomes, and many households have been driven to save less and draw on their pandemic savings, to afford rising costs of living and debt-servicing costs. Households have also lowered their debt accumulation, particularly of mortgages, as seen by the shrinking aqua bars in Chart 1 which represent the loans from UK banks. Taken together, these two pressures on households have led to lower deposit flows into UK banks.

Corporates also responded to higher interest rates by repaying debt (green and aqua bars), thus increasing their net lending position (Chart 2). The deleveraging reduced corporates’ gross debt to earnings ratio to 275% in 2023 Q3, down from its pandemic peak of 345% in 2020 Q4. While the aggregate position of UK corporates has improved, there remains a tail of corporates with high leverage. These highly leveraged corporates are associated with a greater probability of distress and refinancing difficulties. Similar to households, corporates are showing a reduction in deposit levels with UK banks in recent data (purple lines in Chart 2).

Summing up

This blog sheds light on how the flow of funds framework can help policymakers understand the wider macroeconomic developments affecting households and corporates. Using the flow of funds framework, our narrative highlights several trends in the borrowing behaviours of households and corporates in different time periods. For instance, we observe certain trends for both households and corporates, such as, in the pre-GFC era, we saw credit expansion in the household and corporate sectors that ultimately reduced the resilience of the real economy during and after the GFC crisis. More recently, during the Covid pandemic and the years that subsequently followed, households and corporates experienced shifts in their debt levels owing to the government stimulus measures such as enhanced unemployment benefits for households, and government-backed loans for corporates. As economic conditions recovered in the immediate aftermath of the pandemic, some corporates started deleveraging while households reduced their debt levels. Understanding these flows from the financial account is important to gauge the subsequent accumulation of assets and liabilities in the real economy as it helps policymakers to set the ‘macro’ context. Therefore, in this blog we argue that flow of funds is an effective complement to the micro-data analysis which underpins our assessment of household and corporate risks in recent financial stability publications.

Laura Achiro and Neha Bora work in the Bank’s Macro-financial Risks Division and Gerry Gunner works in the Bank’s International Surveillance Division.

If you want to get in touch, please email us at [email protected] or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

Share the post “Flow of funds and the UK real economy”

Publisher: Source link