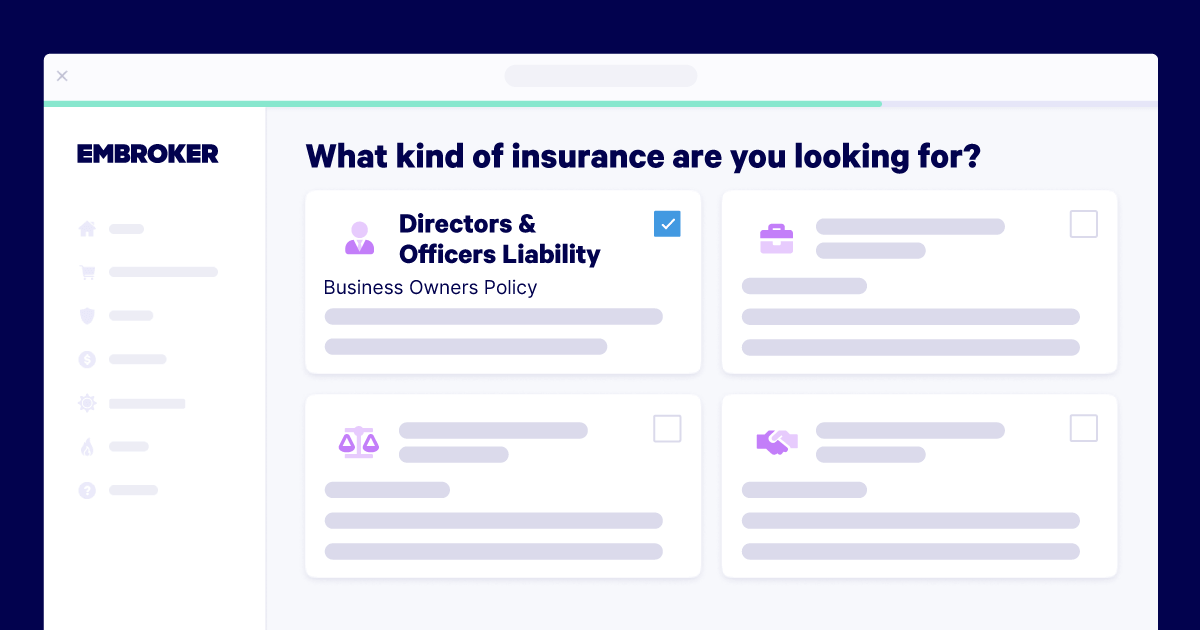

At Embroker, we’re excited to announce the launch of our new coverage program designed for real estate agents and brokers. As a digital insurance company committed to simplifying business insurance, we’ve developed this innovative program on our ONE technology platform. It offers a comprehensive solution that includes professional liability, cyber, business owners’, and workers’ compensation coverage through a streamlined, single-application experience.

Real Estate Agent Insurance, Made Easy

Multiple policies, one quote. So you can get back to what matters.

Understanding the Industry’s Unique Challenges

To ensure our new program truly addresses the needs of real estate professionals, we conducted an in-depth survey of more than 150 real estate leaders, agents, and auditors in May 2024. The insights we gained revealed an industry facing significant pressures and unique risks, confirming the need for specialized insurance coverage.

Our survey uncovered some striking statistics:

- 51% of real estate professionals rely almost exclusively on their cell phones

- 35% frequently make mistakes when using mobile devices

- 46% of companies have experienced financial losses due to these errors

- 48% of real estate professionals filed a professional liability claim in the past year

Addressing the Growing Cyber Threat

We also found that cyber threats are an increasing concern for real estate agents and brokers.

- 45% say they have experienced a breach

- 82% have encountered phishing attempts

- Only 37% have recently updated their cyber coverage

- 47% anticipate increased cyber threats

These findings underscore the critical need for strong cyber liability coverage in the real estate industry, which we’ve made a key component of our new program.

Our Comprehensive Coverage Solution

We’ve designed our new program to address these industry-specific challenges, while providing the foundational coverage that every business needs. Our program includes:

- Tailored professional liability coverage for high-stakes real estate transactions

- Cyber liability protection against existing and emerging digital threats

- A comprehensive business owners’ policy covering property damage, business interruption, and general liability

As our CEO, Ben Jennings, explains:

“Real estate as a profession is facing radical change. Amid layoffs, cyber-attacks, and shifting buying behaviors, agents and brokers too often aren’t getting the coverage they need out of their insurance policies. Given the rapid evolution of the industry, real estate professionals need truly tailored coverage that provides peace of mind so they can operate worry-free. Embroker’s approach provides them with a single-destination solution, an elevated purchasing experience, and comfort that comes with coverage built for their specific needs, not generic coverage.”

A Single-Destination Solution

At Embroker, we pride ourselves on providing a single-destination solution. Our approach offers a fast and easy buying experience and the peace of mind that comes with knowing your coverage is specially tailored for your needs. We’ve designed this comprehensive program to eliminate the gaps often found in generic policies, ensuring that every aspect of a real estate firm’s operations is safeguarded.

As the real estate industry continues to evolve, we’re committed to expanding and adapting our program to consistently meet the needs of this dynamic sector. Our goal is to provide real estate professionals with the peace of mind they need to focus on their core business activities.

We’re thrilled to offer this specialized coverage to the real estate community and look forward to supporting professionals in this vital industry. For more information on our new real estate program or other coverage options, please visit www.Embroker.com/Real-Estate/.

Real Estate Agent Insurance, Made Easy

Multiple policies, one quote. So you can get back to what matters.

Publisher: Source link