IT professionals help set up computer systems, monitor digital security, and improve functionalities for a wide variety of clients. They’re also often called when there’s a problem. So, if something goes wrong, IT consultants need to make sure that they have insurance policies in place to keep them protected. That’s why we’ve created this IT consultants insurance guide.

Consultant Insurance, Made Easy

Multiple policies, one quote. Your advice shouldn’t cost you.

The spectrum of potential problems and resolutions are vast, and all come with their own set of inherent risks. After all, if you recommend that a client turn off their laptop and then it won’t turn back on, there’s a whole new set of concerns to address in addition to the initial glitch.

Whether you’re an IT analyst, custom programmer, software consultant, or developer, there’s always a chance that even the most mundane of tasks could go south. And that’s why IT insurance and other general policies should be essential components of your business. Here we make it easy to understand what insurance you need as an IT consultant and why.

IT Consultants Insurance Guide: Must-HavePolicies

Most of your work may be in the cloud, but that doesn’t mean you’re safe from everyday threats on the ground. There’s ransomware and digital attacks to worry about, of course, but there’s also your reputation, equipment, and employees — if you have them — to protect too. Having different insurance policies in place can help mitigate the multitude of risks you face and protect your business. Below are the main policies that IT consultants should consider.

- Professional Liability: In the world of tech, this is also known as Technology Errors and Omissions (E&O) Insurance, which covers lawsuits related to work performance. Specifically, it can come in handy if you make a coding mistake, unintentionally leave a client vulnerable to a data breach, violate copyright, or make some other kind of human error and your client responds with a lawsuit. Professional Liability will cover the costs of the lawsuit, but can also help recover costs that your business may incur due to any reputational damage or time lost.

- Cyber Liability Insurance: This policy can help your business recover if a data breach or cyberattack occurs. Cyber Insurance will help pay for recovery expenses and other associated costs.

- General Liability Insurance: Any business owner should obtain General Liability coverage. It protects your business assets from injury related to your services and responds to negligence claims made by a third party.

- Business Owner’s Policy (BOP): A BOP will bundle various coverage types under one policy. Your plan can include General Liability (see above) as well as other relevant insurance policies for IT consultants including Workers Compensation, Commercial Property, or Auto coverage. If you own your own firm and have employees, Workers Comp will help protect IT consultants from work injury costs that health insurance might deny — not to mention many states require it if employees meet payroll requirements. Further, Commercial Property can pay for property damage and Auto Insurance can pay for medical bills in an accident involving a company vehicle.

Putting Your IT Insurance to Work

Do you have a spotless record and just can’t imagine how paying for insurance will pay off for your IT business? Here are some examples that can help paint the picture a bit more clearly:

- Perhaps a California-based client experienced a data breach and you did not know that meant that they had to notify their customers of it. Not only could your client sue you for the breach itself, but they may also accuse you of negligence, as there are state-by-state notification laws in place. You might think that they could have sought out that information themselves, however they look to — and phttps://www.embroker.com/coverage/tech-errors-omissions/ay — you for technical oversight and that could be enough to merit a lawsuit.

- You could also find yourself in a situation where you recommend and install equipment for a new business. All seems fine until people start using the devices and deem them faulty. The client could sue you for the cost of new equipment, the time it takes to reinstall it, and the time they lost due to the delay.

- Finally, imagine you own and operate a small IT firm. Your employee gets into an accident on their way to a client training session in a work vehicle. They will be out of work for one month as a result. You’ll need to not only cover their medical bills, but hire a temporary consultant to cover for them during that time too.

In all of these situations, you are personally responsible for client losses as well as your own losses if you don’t have insurance. This could put things like your home, savings, and other assets at risk. If you do have coverage, you’ll get the financial help you need when you’re most vulnerable. IT insurance policies cover legal fees from dissatisfied clients, injuries, and thefts, and may compensate you for your own time lost working while you were dealing with the issue.

How Much Does Insurance for IT Consultants Cost?

Insurance costs will vary from person to person or firm to firm. Factors that will impact the cost of your policies include:

- The size of your business

- The size of your clients’ businesses and their customer networks

- The IT services you provide

- Where you work

- The equipment you use

- Your claims history (if you have one)

Remaining claim-free or having a low claim history will help with your insurance coverage costs. Additionally, proper prevention and risk management plans can help minimize risks and, in return, help you save on coverage.

How to Find the Best Insurance Provider

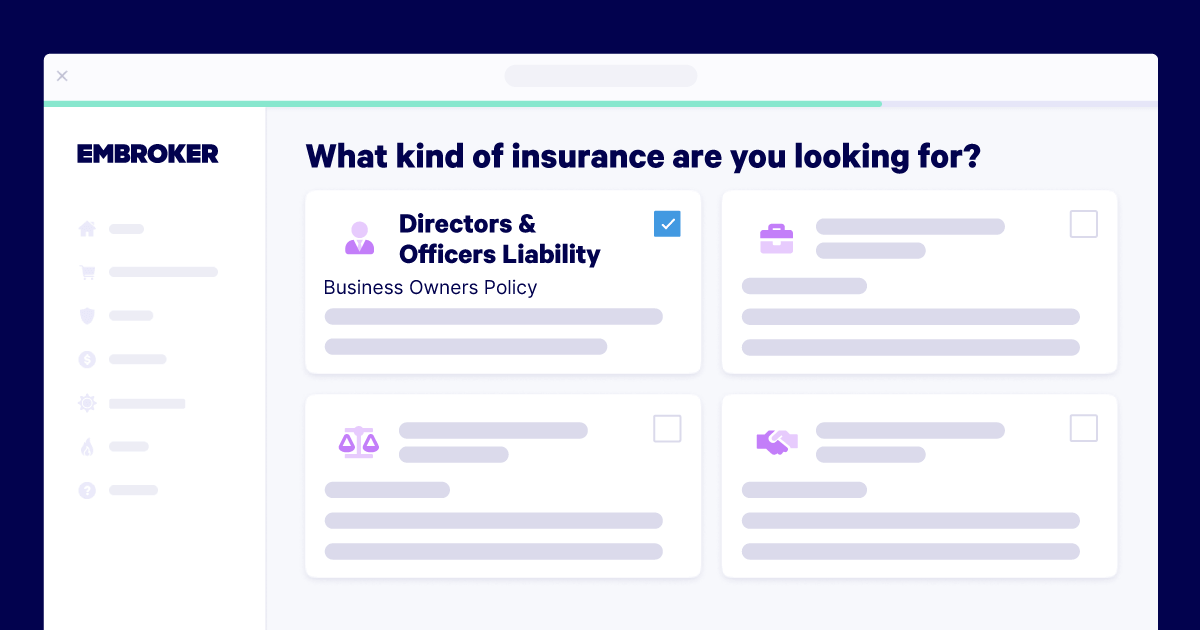

Getting the insurance you need doesn’t have to be complicated, time-consuming, or even require a face-to-face conversation. Look for a provider who can customize a plan for your unique needs and includes all of the must-have policies outlined above. Not sure where to start?

Embroker keeps things simple and digital, making it easy to find a broker, apply for insurance, and receive a certificate online.

As an IT consultant, you face different risks than other business consultants. Your work, given its implications on a company’s technology, requires more specific professional liability.

Learn more about getting Technology Errors & Omissions insurance with Embroker here.

Also, check out our Consultants Insurance Program for easy applications, quick quotes, and coverage tailored to your business needs.

Consultant Insurance, Made Easy

Multiple policies, one quote. Your advice shouldn’t cost you.

Publisher: Source link