James Waddell and Meghna Shrestha

An increasing number of households in the UK are opting for longer-term mortgages, with the share of borrowers taking out new mortgages with terms 30 years or longer tripling since 2005. But who are these households, why have they done so, and what could this imply for financial stability?

This blog presents some analysis to answer these questions, and focuses on three potential risk channels which could affect financial stability. These can be broadly classified into: (i) lending into old age; (ii) increased leverage; and (iii) higher debt persistence. We judge the risks associated with longer-term mortgages are limited and are mitigated by existing Financial Policy Committee (FPC) and Financial Conduct Authority (FCA) policies, which limit risky lending both at the borrower level and in aggregate.

Who is taking out longer-term mortgages and why?

The term of a mortgage refers to the length of time over which the mortgage is repaid, which typically has been 25 years. This is different to the period interest rates are fixed for, which are mostly two or five years.

Recently, mortgage terms have been lengthening, and mortgages of 30 years or longer have become increasingly more popular. The proportion of borrowers taking out new mortgages with terms of 30 years or longer has risen from 12% in 2005 Q4 to 50% in 2024 Q1 (Chart 1).

Longer-term mortgages are most prevalent among younger borrowers and first-time buyers. In 2024 Q1, 81% of mortgages taken by borrowers aged under 35 were for terms of 30 years or longer, compared to just 1% where the borrower was 45 or older. First-time buyers (FTBs) are the most likely to borrow on longer terms, with 67% borrowing for terms of 30 years or longer, while home movers are the next most likely with 42%.

Chart 1: Share of mortgages by term length (in % of new lending) (a)

Source: FCA Product Sales Database (2024 Q1).

(a) Mortgages include FTBs, homemovers and external remortgages with a change in principal. Internal remortgages, remortgages without a change in principal, further advances, mortgages flagged as a business loans and lifetime mortgages are excluded.

Why have we seen this increase in mortgage terms? Rising interest rates, increased costs of living and higher house prices have all contributed to make mortgages less affordable. Therefore, households have been looking for ways to adjust their mortgages. One such way is to extend their terms so that, all else equal, borrowers can lower their monthly mortgage repayments. Lower mortgage payments in the face of shocks helps keep households’ debt-servicing ratios (DSRs) in check. Higher DSRs are associated with greater probability of defaulting on debt, smaller savings buffers, and greater financial vulnerability. So, in the short term, the flexibility to take longer-term mortgages has made borrowers more resilient to shocks.

However, there may be longer term consequences for financial stability from longer mortgage terms becoming the norm, which we will explore in the remainder of this blog.

How can longer mortgage terms affect future borrower and lender resilience?

We identify three channels through which longer mortgage terms could affect borrower resilience and lender resilience: (i) lending into old age, where incomes are less certain and can be substantially lower; (ii) increase in leverage, where longer mortgage terms allow borrowers to take on more debt relative to their income; and (iii) higher debt persistence, with existing debt taking longer to be paid off.

Risk 1: Lending into old age

Increasingly borrowers are taking mortgages that will last until they are older than 67, which is the planned state retirement age. These mortgages made up 27% of new lending in 2019 Q1 and reached 42% in 2024 Q1 (Chart 2).

Retirement income is often lower or more uncertain, so continued borrowing into retirement could provide challenges for mortgagors to continue to meet mortgage payments.

Furthermore, if new mortgages are issued at lengths already at the maximum duration lenders are comfortable with, then borrowers will have less flexibility to extend these terms in response to a future interest rate increase or income shock. This could reduce future borrower resilience.

However, there are several mitigants to the risks associated with lending into old age. Many lenders have their own policies on the maximum borrower age they will lend to. And on lending into older age that does occur, the FCA’s responsible lending rules guard against the risk that mortgage payments become unaffordable. These rules require lenders to take into account likely or expected future changes in a borrower’s income and expenditure, including due to retirement, when assessing affordability, and to collect information on expected future borrower income.

We see in Chart 2 that lending bunches where borrowers would be 69 and 74 years old at mortgage maturity, with little lending beyond that point. The FCA’s responsible lending rules and lenders’ own policies likely contribute to limited lending deeper into retirement.

Chart 2: Borrower age at mortgage maturity on new mortgage lending for a sample of periods

Source: FCA Product Sales Database (2024 Q1).

Risk 2: Increased leverage

Borrowers may opt for longer terms to reduce their mortgage payment, but doing so can also allow them to borrow more. Indeed, higher loan to income (LTI) ratios are associated with longer-term mortgages (Chart 3).

But Bank of England analysis has shown that LTIs (on average) have fallen on new lending over the past few years as mortgage rates have risen, and in turn stress-tested rates have risen, which has made affordability the binding constraint on borrowing. And LTIs have fallen even as mortgages have continued to lengthen.

In any case the FPC’s LTI flow limit, which limits the number of mortgages that can be extended at LTI ratios at or greater than 4.5 to 15% of a lender’s new mortgage lending, continues to guard against the risk of excessive household leverage. Around 5% of new mortgage lending was at an LTI of 4.5 or higher in 2024 Q1.

Chart 3: Mean terms on mortgages by LTI buckets

Source: FCA Product Sales Database (2024 Q1).

Risk 3: Higher debt persistence

All else equal, borrowers with longer mortgage terms spend a larger share of their monthly repayments towards paying interest and less towards paying off loan principle. This means borrowers will take longer to reduce their outstanding loan amount.

One consequence of this is that borrowers on longer-term mortgages pay more interest over the life of their loans. And all else equal these borrowers will reduce their loan to value ratios (LTVs) slower. Borrowers on longer terms may more slowly reach lower LTV levels, which typically attract lower mortgage rates.

Higher LTVs narrow borrower equity by definition, which increases losses lenders would face in the event of a mortgage default.

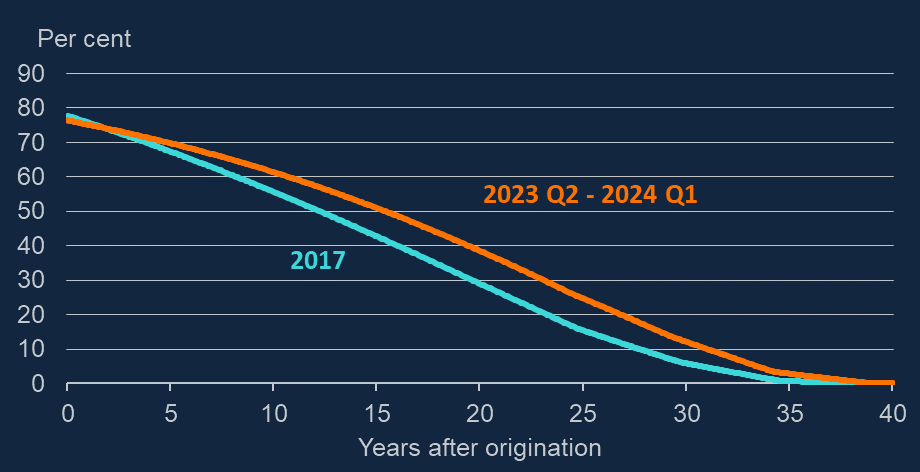

However, a simple exercise tells us longer mortgage terms are unlikely to make a large difference to average LTVs. We take mortgages of all durations issued to FTBs in 2017 and between 2023 Q2 and 2024 Q1, and project forward the outstanding loan balance over time, using the monthly repayment and the mortgage interest rate. We use these projected loan amounts and property values at loan origination to update the loan to origination value ratios for each loan. We then compute the average LTV for the two cohorts. This proxy for updated LTVs is projected to be higher for loans taken more recently, but the difference between the two cohorts is small (Chart 4).

Chart 4: Average loan to origination values on loans taken by FTBs in 2017 and 2023 Q2–2024 Q1 (a)

Sources: FCA Product Sales Database (2024 Q1) and author calculations.

(a) Analysis excludes interest-only and partially interest-only mortgages.

Conclusion

Longer-term mortgages as a share of new lending have increased since at least 2005 and accelerated more recently. Longer-term mortgages allow borrowers to manage the affordability pressures associated with higher house prices to incomes, cost of living, and higher mortgage rates. This however comes with some associated risks which could build over time if the trend continues.

Longer mortgage terms could affect financial stability by pushing debt repayments beyond retirement, where incomes are less certain. They allow borrowers to take on a higher level of debt relative to income, and could cause greater debt persistence. However, we judge these risks are relatively small and are mitigated by rules from the FCA that guard against the risk that mortgage payments become unaffordable, and by the FPC’s LTI policy that limits risky borrowing in the aggregate.

James Waddell and Meghna Shrestha work in the Bank’s Macro-Financial Risks Division.

If you want to get in touch, please email us at [email protected] or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

Share the post “30+ year mortgages – are these the new norm? What does this mean for financial stability?”

Publisher: Source link