They say to never say never. But why?

Because if you say it, whatever you said would never happen typically happens. Go figure.

Well, speaking of, Fannie Mae chief economist Doug Duncan recently said barring a “catastrophic economic event,” not to expect mortgage rates to return to 3% in our lifetimes.

I wrote about it on Twitter and it garnered a big reaction, with most saying he’s right. And others asking how old he was…

My take was that when I hear things like “not in our lifetime,” I naturally expect them to occur sooner rather than later.

How Did We Get 3% Mortgage Rates to Begin With?

Before we talk about the possibility of mortgage rates being 3% again, let’s discuss how they got there in the first place.

After the early 2000s mortgage crisis led to the Great Recession between 2007 and 2009, the Fed took action to lower its own lending rate (the federal funds rate) to nearly zero.

This was done to increase economic output by encouraging banks to lend money and for consumers and businesses to take out loans.

Despite the Fed’s best efforts, the economy continued to contract, leading to the advent of an unconventional monetary policy called Quantitative Easing, or QE.

Without getting too wordy here, the Fed began buying long-dated treasuries and mortgage-backed securities (MBS) to stimulate lending and turn the economy around.

Thanks to a very large, new buyer in the market, bond prices went up and their yields (aka interest rates) plummeted, as did consumer mortgage rates.

By the end of 2011, the 30-year fixed fell just below 4%, per Freddie Mac, as seen in the FRED chart above. And in 2012, it was in the low-3% range.

The Fed’s QE program was launched in 2008 and ran all the way until 2020, thanks to COVID-19 requiring an additional round.

Effectively, it was the perfect storm of a zero-interest rate policy (ZIRP) coupled with enormous buying of agency mortgage-backed securities. They currently hold over $2.5 trillion in MBS!

This led to the lowest priced 30-year fixed mortgage on record, and many lucky American homeowners got their hands on one.

Could the Same Thing Happen Again?

Anything is possible, which is why I say never say never. But as Duncan noted, it might take a bit of a catastrophe. Or possibly a major geopolitical event. Or both.

Some wrongly claimed we needed a pandemic to see 3% mortgage rates, but if you study the mortgage rate timeline, that’s simply not true.

As noted, the 30-year fixed was sub-4% all the way back in 2011, nearly a decade before COVID-19 reared its ugly head.

Yes, the pandemic led to even lower mortgage rates, with the 30-year fixed falling to a record low 2.65% during the week ending January 7th, 2021, per Freddie Mac.

But all it took was a Global Financial Crisis (GFC) to get us to 3% mortgage rates. Easy-peasy (kidding).

This isn’t to say it’s right around the corner, but it’s clearly possible. Of course, these might be generational events.

So lifetime might be the wrong word choice here, but generation could be right. As in, not in this generation. But perhaps the next one.

If a generation is around ~30 years, this means many people could see this same thing play out again, though maybe not very soon.

However, things tend to move a lot quicker these days and some argue that we live in a low interest rate world now where a return to double-digit interest rates is unimaginable.

And even long-term average rates could be unthinkable to some given how high home prices are these days.

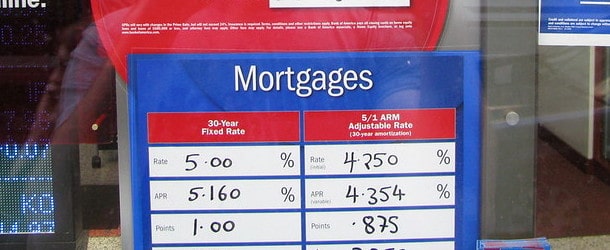

If you consider the average 30-year fixed mortgage rate over the past 50 years, it’s around current levels of just over 7%.

If we throw out the extreme 1980s mortgage rates, the long-run average is closer to 5.5%. But that includes the crazy low-rate years over the past decade…

How About 4% Mortgage Rates?

While I do agree with Duncan’s general sentiment that a return to a 3% 30-year fixed is unlikely, at least anytime soon, we could get somewhat close.

It wouldn’t shock me to see a 30-year fixed start with a ‘4.’ As in 4.99%, or something to that effect.

Heck, the home builders are still offering special mortgage rate buydowns that low at this very moment.

And if you’re willing to pay discount points at closing, if/when rates moderate as inflation falls, a 4.99% rate could be within reach.

Even without points, rates could get close to those levels if the economy cools rapidly and the Fed begins cutting its own rate again.

Remember, bad economic news is a friend to mortgage rates, so if unemployment spikes, and production/spending declines, rates could come down pretty quick.

At this juncture, many expect the Fed to begin cutting rates as their inflation fight wanes, which if the 10-year bond yield cooperates, could lead to a 30-year fixed closer to 6% by 2025.

And maybe even lower if mortgage rate spreads normalize. This alone could get some borrowers back into the high-5% range without paying a ton at closing.

Of course, that’s all speculation and nobody really knows for certain which way mortgage rates might go.

What Are Your Options If 3% Mortgage Rates Don’t Return?

Even if the 3% mortgage doesn’t return, there are various options to lessen your mortgage interest expense.

For one, there’s always buying down your rate, which involves paying discount points upfront for a lower rate the entire loan term.

This is a form of prepaid interest where you pay more today, but potentially save a lot more over the loan term. You just have to keep the loan long enough for it to make sense.

There’s also paying extra on your mortgage, which depending on how much more you pay each month, could lower your effective mortgage rate to something closer to 4-5%, or even 3%.

The more you pay toward principal, the less interest you pay, which makes your mortgage operate more like a low-rate home loan.

We’ve also seen a resurgence in assumable mortgages, which allow a home buyer to take on the seller’s loan as well.

Many millions of existing homeowners have mortgage rates in the 2-3% range, so it might be possible to buy their house AND snag their low-rate mortgage.

One new service trying to make this process easier is called Roam. And there are others like it out there too.

Finally, if you’re buying a new home, look out for special rate buydowns from the home builder’s lender that offer a below-market rate.

Or if you’re buying a used home, ask for seller concessions, which can be used to buy down the interest rate.

And remember, you’re not necessarily stuck with your rate forever. If rates go down, look into a rate and term refinance to take advantage.

Publisher: Source link